The Average Directional Index (ADX) is a technical analysis indicator used to measure the strength of a market trend, not its direction. It helps traders determine whether a market is trending strongly or moving sideways, which is critical for choosing the right trading strategy.

Developed by J. Welles Wilder Jr., the ADX is widely used across stocks, forex, commodities, and cryptocurrencies. In the first paragraph of most trading guides, ADX is described as a tool that answers one key question: Is the trend strong enough to trade?

Key Takeaways

The Average Directional Index (ADX) is a reliable tool for assessing whether a trend is strong enough to trade. It does not predict direction but enhances timing, filtering, and risk management.

When used thoughtfully and combined with other analysis methods, ADX can significantly improve consistency and confidence in trading decisions.

What the Average Directional Index (ADX) Measures

The core purpose of the Average Directional Index is to quantify trend strength on a scale from 0 to 100. A higher reading signals a stronger trend, while a lower reading suggests weak or nonexistent trend conditions.

Unlike many indicators, ADX does not tell traders whether the price is moving up or down. Instead, it focuses entirely on how powerful the current price movement is, regardless of direction.

Components of the ADX Indicator

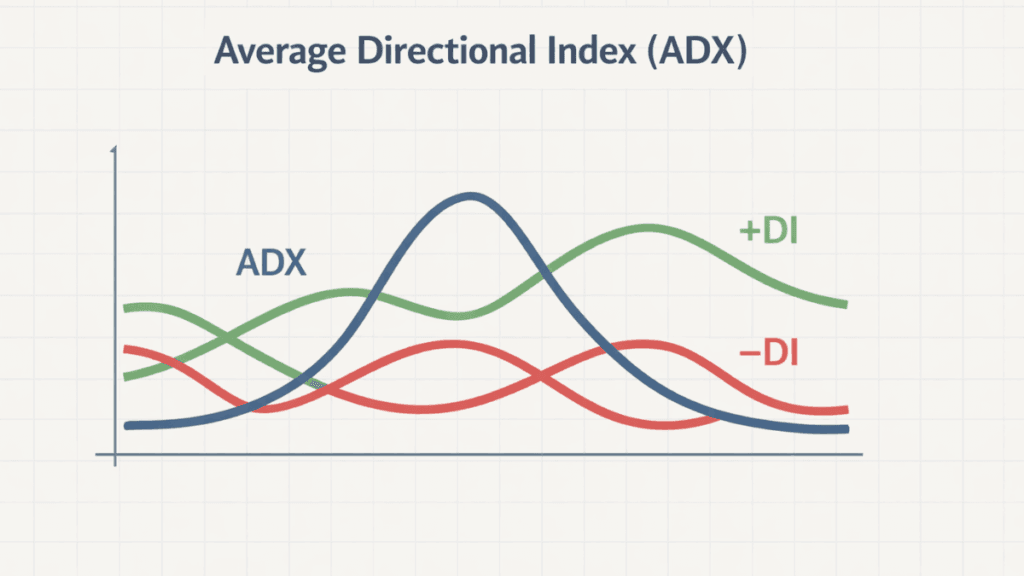

The ADX indicator consists of three lines that work together to describe market behavior. Understanding these components is essential before using the indicator in real trading decisions.

ADX Line

The ADX line represents overall trend strength. When this line rises, it signals that momentum is increasing, while a falling ADX suggests weakening momentum.

Traders often focus on whether the ADX is above or below key threshold levels rather than its exact numerical value.

Positive Directional Indicator (+DI)

The +DI line measures upward price movement. When +DI is above −DI, bullish pressure is stronger than bearish pressure.

This line does not confirm a trend on its own but becomes meaningful when analyzed alongside ADX and −DI.

Negative Directional Indicator (−DI)

The −DI line tracks downward price movement. When −DI is above +DI, sellers are dominating the market.

The interaction between −DI and +DI helps traders understand directional bias, while ADX confirms whether that bias is strong enough to matter.

How the Average Directional Index (ADX) Is Calculated

The ADX calculation is based on smoothed averages of price range and directional movement. While the math behind it is complex, most traders rely on charting platforms to compute it automatically.

What matters more than the formula is the interpretation. ADX smooths out price noise to focus on sustained movement, which is why it excels at filtering out choppy market conditions.

Interpreting ADX Values

ADX values are typically interpreted using broad ranges rather than precise numbers. These ranges provide practical guidance for decision-making.

- Below 20: Weak trend or sideways market

- 20–25: Trend may be forming

- 25–50: Strong trend

- Above 50: Very strong trend, often near exhaustion

These thresholds are guidelines, not rules, and should always be used alongside other forms of analysis.

Using ADX to Identify Trending vs. Ranging Markets

One of the most valuable uses of the Average Directional Index is distinguishing between trending and non-trending markets. This helps traders avoid strategies that perform poorly in the wrong environment.

When ADX stays below 20, range-bound strategies such as support and resistance trading tend to work better. When ADX rises above 25, trend-following approaches usually become more effective.

Combining ADX with +DI and −DI Signals

ADX becomes more powerful when used together with its directional components. The relationship between +DI and −DI provides directional context that ADX alone cannot offer.

A common interpretation approach includes:

- +DI crossing above −DI with rising ADX suggests a strengthening uptrend

- −DI crossing above +DI with rising ADX suggests a strengthening downtrend

The key is that ADX should be rising to confirm that the directional signal has meaningful strength.

ADX as a Trend Strength Filter

Many traders use ADX as a filter rather than a standalone signal. This means they only take trades when ADX confirms sufficient momentum.

For example, a trader might ignore moving average crossovers when ADX is low, reducing false signals during choppy price action. This filtering role is one of the main reasons ADX remains popular decades after its creation.

Strengths of the Average Directional Index

The Average Directional Index offers several advantages that make it a staple in technical analysis. Its ability to remain direction-neutral is particularly useful in volatile markets.

ADX is also highly adaptable and works well across different timeframes, from short-term charts to long-term trend analysis.

Limitations of the ADX Indicator

Despite its strengths, ADX has important limitations. It is a lagging indicator, meaning it reacts after a trend has already begun.

In fast-moving markets, ADX may rise only after a large portion of the move has already occurred. For this reason, it is best used for confirmation rather than prediction.

ADX vs. Other Trend Indicators

ADX differs from indicators like moving averages or MACD because it measures strength rather than direction or momentum crossover. This makes it complementary rather than competitive with other tools.

When combined with price action, volume, or momentum indicators, ADX often improves overall signal quality and reduces overtrading.

Practical Example of ADX in Trading

Consider a market that has been moving sideways for weeks with ADX below 15. A breakout occurs, and ADX begins rising above 25 while +DI moves above −DI.

This combination suggests that the breakout is supported by increasing trend strength. Traders may use this confirmation to stay in the trade longer instead of exiting early due to minor pullbacks.

Common Mistakes When Using ADX

New traders often misinterpret ADX as a directional signal. This misunderstanding can lead to trades taken in the wrong direction.

Another common error is relying on ADX alone. Without price context or directional confirmation, ADX readings can be misleading.

Why the Average Directional Index (ADX) Still Matters

The Average Directional Index remains relevant because markets still alternate between trending and ranging phases. ADX helps traders adapt to these changes instead of forcing one strategy onto every market condition.

By focusing on trend strength rather than prediction, ADX encourages disciplined, context-aware decision-making that aligns with professional trading practices.