A Double Top is a classic chart pattern used in technical analysis to signal a potential reversal from an uptrend to a downtrend. It forms when the price reaches a similar high level twice but fails to break higher, suggesting that buying pressure is weakening.

In simple terms, the Double Top reflects a market that has tried and failed twice to push prices higher. This repeated failure often warns traders that sellers may soon take control.

What Is a Double Top Pattern?

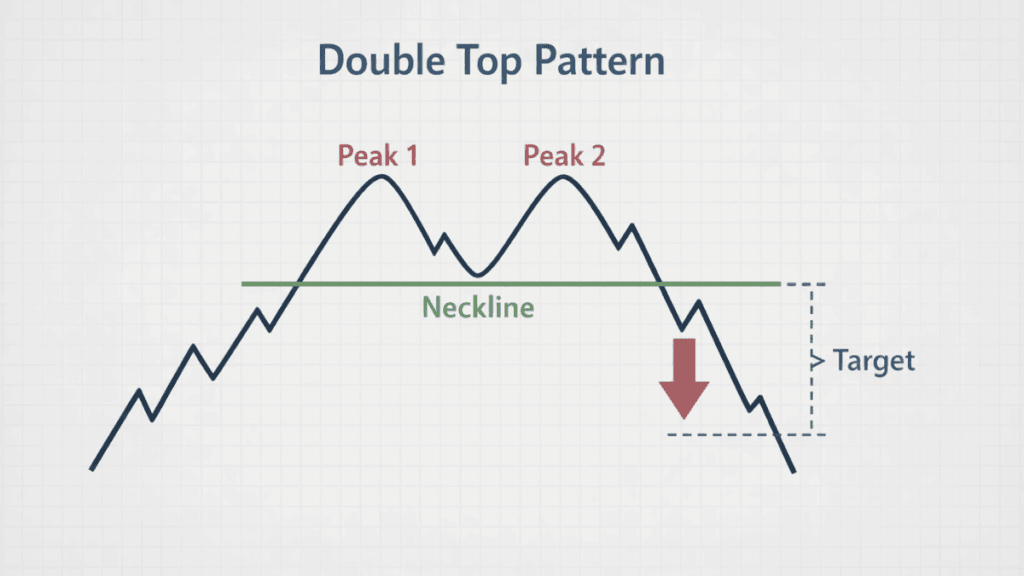

A Double Top pattern is a bearish reversal formation that appears after a sustained upward price move. It is characterized by two peaks at roughly the same price level, separated by a temporary decline.

The pattern shows that buyers were strong enough to push prices up once, but not strong enough to maintain momentum on the second attempt. As confidence fades, selling pressure increases, increasing the likelihood of a downward move.

Key Components of a Double Top

Every Double Top follows a recognizable structure that helps traders identify it with more confidence. Understanding each component makes the pattern easier to spot and interpret.

First Peak

The first peak forms when the price reaches a new high during an uptrend and then pulls back. This pullback is normal and does not yet suggest a reversal.

At this stage, the trend is still considered bullish, and many traders view the decline as a temporary pause rather than a warning sign.

Second Peak

The second peak occurs when the price rises again to a similar level as the first peak but fails to move higher. This inability to break resistance signals weakening demand.

The second peak is crucial because it confirms that buyers are struggling to maintain upward momentum.

Neckline

The neckline is the lowest point between the two peaks and acts as a support level. It plays a critical role in confirming the pattern.

A Double Top is not considered complete until price breaks below the neckline with conviction.

How a Double Top Forms

A Double Top forms gradually and reflects a shift in market psychology rather than a sudden event. The pattern shows a transition from buyer dominance to seller control.

As the price approaches the same resistance level twice and fails both times, traders who bought earlier may begin taking profits. This behavior increases selling pressure and raises the probability of a downward trend.

What the Double Top Signals

The Double Top signals a potential bearish trend reversal rather than an immediate price drop. It warns that the prior uptrend may be losing strength.

Once price breaks below the neckline, many traders interpret this as confirmation that sellers are in control. This breakdown often leads to increased volume and accelerated downside movement.

How Traders Use the Double Top

Traders use the Double Top to manage risk, identify exit points, or plan short-selling opportunities. The pattern is especially useful when combined with other technical tools.

Common trading approaches include:

- Entering short positions after a confirmed neckline break

- Placing stop-loss orders above the second peak

- Measuring potential downside by projecting the height of the pattern below the neckline

These techniques help traders structure trades with defined risk and reward.

Double Top vs. Double Bottom

The Double Top is often compared to its bullish counterpart, the Double Bottom. While the shapes look similar, their implications are opposite.

A Double Top signals potential downside after an uptrend, while a Double Bottom suggests potential upside after a downtrend. Understanding this contrast helps traders avoid confusing reversal signals.

Reliability and Limitations of the Double Top

The Double Top is widely respected, but it is not foolproof. Like all chart patterns, it works best when supported by additional evidence.

False signals can occur if the price briefly breaks the neckline and then quickly reverses. For this reason, traders often wait for confirmation from volume, momentum indicators, or broader market conditions.

Common Mistakes When Trading Double Tops

Many traders misinterpret Double Tops by acting too early or ignoring confirmation. These errors can lead to unnecessary losses.

Common mistakes include:

- Entering trades before the neckline is broken

- Ignoring the overall market trend and context

- Assuming exact symmetry between the two peaks

A disciplined approach reduces these risks and improves consistency.

Double Top in Different Markets

The Double Top appears across many asset classes, including stocks, forex, commodities, and cryptocurrencies. Its reliability tends to increase in liquid markets with clear trends.

Regardless of the market, the underlying psychology remains the same: repeated failure at resistance weakens bullish confidence and strengthens bearish expectations.

Why the Double Top Matters

The Double Top remains popular because it visually captures a shift in market sentiment. It helps traders recognize when optimism is fading, and caution is warranted.

By understanding how the pattern forms and what it represents, traders can make more informed decisions and avoid chasing trends that may be near exhaustion.

Final Thoughts

The Double Top is a foundational concept in technical analysis and an essential entry in any trading glossary. It offers valuable insight into price behavior and market psychology when used correctly.

While it should never be used in isolation, the Double Top provides a clear framework for spotting potential trend reversals and managing risk with greater confidence.