The Evening Doji Star is a bearish candlestick reversal pattern that appears after an uptrend and warns that buying pressure is fading. It is widely used by technical traders because it combines price structure with market psychology in a clear and disciplined way.

This pattern stands out because it reflects hesitation at the top of a rising market, followed by confirmation that sellers are starting to take control. When identified correctly and used with confirmation, it can help traders manage risk and avoid entering trades late in an uptrend.

What Is an Evening Doji Star?

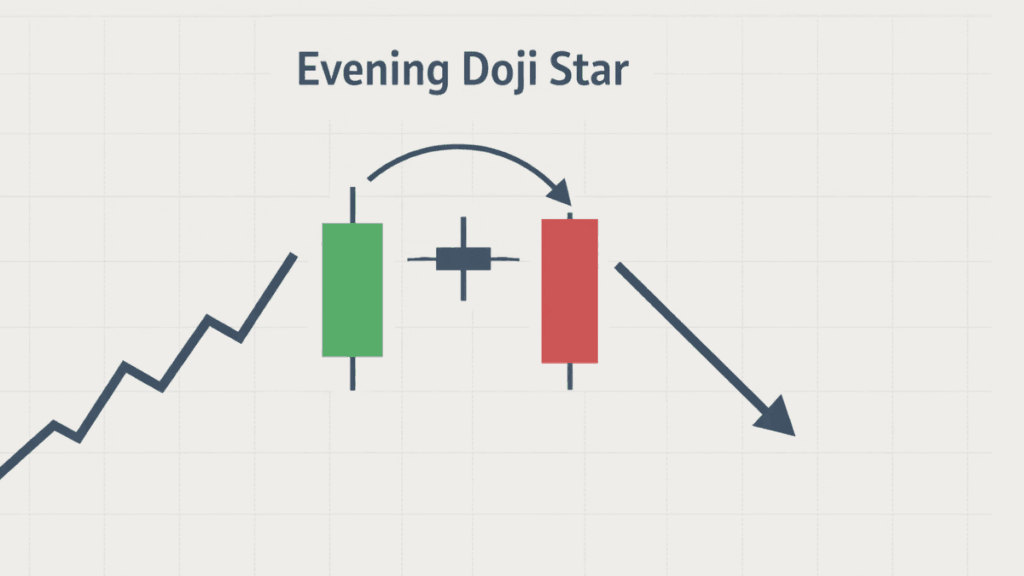

The Evening Doji Star is a three-candle formation that signals a potential shift from bullish momentum to bearish control. It develops at or near market highs, where buyers begin to lose conviction.

What makes this pattern distinctive is the presence of a doji candle in the middle, which shows indecision after a strong upward move. This pause often marks the turning point before prices start to decline.

Structure of the Evening Doji Star Pattern

The pattern follows a specific sequence that traders look for on price charts. Each candle plays a role in revealing the changing balance between buyers and sellers.

- The first candle is a strong bullish candle that continues the existing uptrend.

- The second candle is a doji, where the opening and closing prices are very close, showing hesitation.

- The third candle is a bearish candle that closes well into the body of the first candle.

This structure shows a transition from confidence to uncertainty, and finally to selling pressure.

Psychology Behind the Evening Doji Star

Understanding the psychology of the Evening Doji Star helps explain why it works. The first candle reflects strong optimism, with buyers firmly in control and pushing prices higher.

The doji that follows signals that this confidence is weakening. Buyers and sellers are evenly matched, often because traders begin taking profits or questioning further upside. The final bearish candle confirms that sellers have gained control, often triggering stop-loss orders and fresh short positions.

How to Identify a Valid Evening Doji Star

A valid Evening Doji Star requires more than just three candles in the right order. Context and placement on the chart are critical for reliability.

The pattern should appear after a clear uptrend, not during sideways or choppy price action. The doji should be clearly visible and not confused with a small-bodied candle, and the third candle should show decisive bearish strength.

Difference Between Evening Doji Star and Evening Star

The Evening Doji Star is often compared to the Evening Star, but there is an important distinction. Both are bearish reversal patterns, yet the middle candle is what sets them apart.

In an Evening Star, the middle candle has a small real body, while in an Evening Doji Star, it is a true doji. The doji reflects stronger indecision, which many traders interpret as a more meaningful warning at market tops.

Confirmation Signals Traders Should Look For

No candlestick pattern should be traded in isolation, and the Evening Doji Star is no exception. Confirmation helps filter out false signals and improves consistency.

Common confirmation tools include:

- Increased volume on the bearish third candle

- A break below a short-term support level

- Bearish momentum signals from indicators like RSI or MACD

These signals help validate that sellers are actually taking control rather than price pausing temporarily.

How Traders Use the Evening Doji Star in Trading

Traders use the Evening Doji Star primarily as a warning signal rather than an automatic entry. It often prompts traders to tighten stop-loss levels, take profits on long positions, or prepare for short setups.

Short entries are usually considered after the third candle closes, with risk defined above the recent high. Profit targets are often set near key support zones or based on risk-to-reward rules rather than fixed expectations.

Risk Management When Trading the Evening Doji Star

Risk management is essential when trading reversal patterns because not every signal leads to a sustained move. The Evening Doji Star works best when losses are controlled and expectations are realistic.

Traders commonly place stop-loss orders above the high of the pattern to limit downside risk. Position sizing should reflect the fact that reversals can fail, especially in strong trending markets.

Common Mistakes Traders Make With This Pattern

One common mistake is treating every Evening Doji Star as a guaranteed reversal. Markets can pause and continue higher, especially during strong bullish trends or news-driven rallies.

Another frequent error is ignoring the broader market context. Trading this pattern against a dominant higher-timeframe trend without confirmation often leads to poor results.

Best Markets and Timeframes for the Evening Doji Star

The Evening Doji Star appears across many markets, including stocks, forex, cryptocurrencies, and commodities. It tends to be more reliable on higher timeframes where market noise is reduced.

Daily and weekly charts often produce stronger signals than very short timeframes. On lower timeframes, additional confirmation becomes even more important to avoid false reversals.

Strengths and Limitations of the Evening Doji Star

The main strength of the Evening Doji Star is its clarity. It visually communicates a shift in control and highlights areas where risk is increasing for buyers.

Its limitation is that it does not predict how far prices will fall. Like most candlestick patterns, it signals direction and sentiment, not precise price targets or timing.

Final Thoughts

The Evening Doji Star is a valuable bearish reversal pattern when used with patience and discipline. It works best when combined with trend analysis, support and resistance, and proper risk management.

By understanding its structure and psychology, traders can use this pattern as an early warning tool rather than a standalone strategy. When applied thoughtfully, it can help protect profits and improve decision-making at market tops.