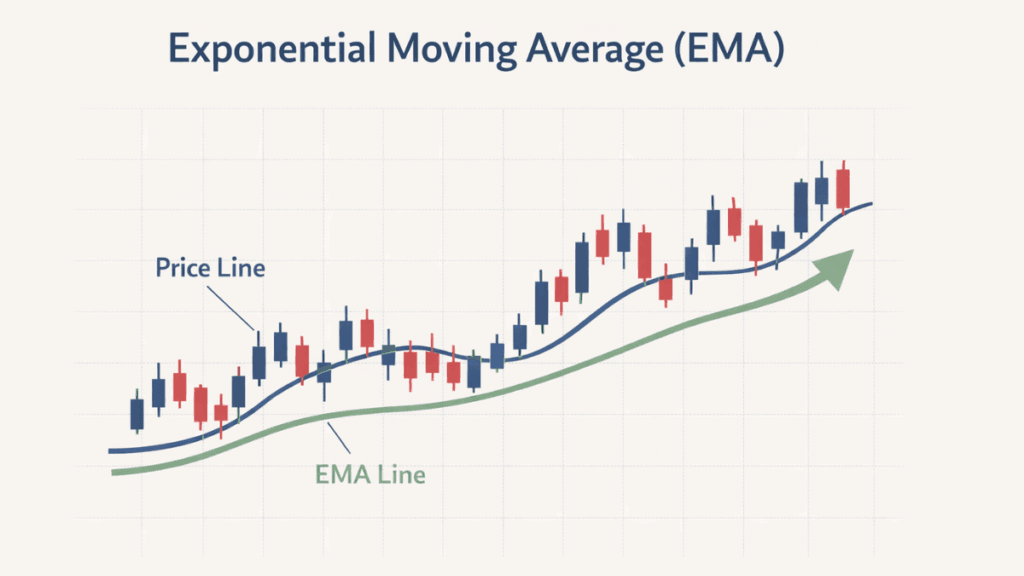

The Exponential Moving Average (EMA) is one of the most widely used indicators in technical analysis because it responds quickly to price changes. Traders and investors rely on it to identify trends, measure momentum, and spot potential entry and exit points in financial markets.

Unlike simpler averages, the EMA gives more importance to recent prices. This makes it especially useful in fast-moving markets where timing matters, such as stocks, forex, and cryptocurrencies.

What Is an Exponential Moving Average (EMA)?

An Exponential Moving Average is a type of moving average that places greater weight on the most recent price data. This weighting allows the indicator to react faster to new information compared to a Simple Moving Average (SMA).

The EMA smooths price data while still staying close enough to the price to reflect short-term changes. This balance between smoothness and responsiveness is the main reason it is so popular among traders.

How the Exponential Moving Average Works

The EMA is calculated using a formula that applies a smoothing factor to recent prices. This factor increases the influence of the latest price while gradually reducing the impact of older data points.

Although the math behind the EMA can look complex, most trading platforms calculate it automatically. What matters for traders is understanding that newer prices matter more, which helps the EMA adjust quickly when market conditions change.

EMA vs Simple Moving Average (SMA)

Both EMA and SMA are trend-following indicators, but they behave differently in real market conditions. Understanding this difference helps traders choose the right tool for their strategy.

The main distinctions include:

- Responsiveness: The EMA reacts faster to price changes, while the SMA moves more slowly.

- Lag: The EMA has less lag, which can lead to earlier signals.

- Stability: The SMA is smoother and may filter out short-term noise better.

Because of these traits, traders often use EMAs for short-term analysis and SMAs for longer-term trend confirmation.

Common EMA Periods and Their Uses

Different EMA lengths serve different trading purposes. Choosing the right period depends on the timeframe and trading style.

Short-Term EMAs

Short-term EMAs, such as the 9-day or 12-day EMA, are designed to track quick price movements. They are commonly used by day traders and scalpers who need fast signals.

These EMAs stay very close to price, which makes them sensitive but also more prone to false signals in choppy markets.

Medium-Term EMAs

Medium-term EMAs, such as the 20-day or 50-day EMA, help identify the overall direction of a trend. Swing traders often use these periods to time entries and exits.

They provide a balance between speed and reliability, making them useful in trending markets.

Long-Term EMAs

Long-term EMAs, such as the 100-day or 200-day EMA, are used to assess the broader market trend. Long-term investors use them to separate bullish and bearish conditions.

When price stays above a long-term EMA, it often signals a healthy uptrend.

How Traders Use the Exponential Moving Average

Traders apply the EMA in several practical ways to analyze price action. Each method offers a different perspective on market behavior.

Trend Identification

The EMA helps traders quickly determine whether a market is trending up or down. When the price consistently stays above the EMA, the trend is generally considered bullish.

When the price remains below the EMA, it usually signals a bearish trend.

Dynamic Support and Resistance

EMAs often act as moving support or resistance levels. Price may bounce off an EMA during a trend, offering potential trading opportunities.

This behavior is especially common with popular EMAs like the 20-day and 50-day.

EMA Crossovers

EMA crossovers occur when a shorter EMA crosses above or below a longer EMA. These crossovers are widely used as trading signals.

A bullish signal forms when a short-term EMA crosses above a long-term EMA, while a bearish signal appears when it crosses below.

Popular EMA-Based Trading Strategies

EMA strategies are popular because they are simple and adaptable. They can be used alone or combined with other indicators.

Single EMA Strategy

A single EMA strategy focuses on price interaction with one moving average. Traders may buy when the price pulls back to the EMA in an uptrend.

This approach works best in strong, clearly defined trends.

Dual EMA Strategy

A dual EMA strategy uses two EMAs, such as the 12-day and 26-day. Trades are based on crossovers between the two lines.

This method helps confirm momentum shifts and reduce emotional decision-making.

EMA with Other Indicators

Many traders combine EMA with indicators like RSI or MACD. This combination helps confirm signals and avoid false entries.

Using multiple tools adds context and improves decision quality.

Advantages of Using the Exponential Moving Average

The EMA offers several benefits that make it a preferred choice for many traders. Its design helps align analysis with real-time market behavior.

Key advantages include:

- Faster reaction to recent price changes

- Reduced lag compared to simple averages

- Flexibility across different timeframes and markets

These strengths make the EMA suitable for both beginners and experienced traders.

Limitations of the EMA

Despite its usefulness, the EMA is not perfect. Understanding its weaknesses helps traders manage risk more effectively.

In sideways markets, the EMA can generate frequent false signals. It also does not predict future prices, but rather reacts to what has already happened.

Best Practices for Using EMA Effectively

Using the EMA correctly requires discipline and context. Traders should avoid relying on it in isolation.

It works best when combined with price action analysis, support and resistance levels, or volume. Testing different EMA periods on historical data can also help refine a strategy.

EMA in Different Markets

The Exponential Moving Average can be applied across many asset classes. Its core principles remain the same regardless of the market.

In stocks, EMAs help identify trend strength. In forex, they assist with timing entries during active sessions. In cryptocurrencies, EMAs are valuable due to frequent price swings.

Final Thoughts

The Exponential Moving Average is a powerful yet simple indicator that adapts quickly to market changes. Its emphasis on recent prices makes it especially useful for modern, fast-moving markets.

When used with proper risk management and supporting analysis, the EMA can become a reliable part of any trading or investing approach.