MACD, short for Moving Average Convergence Divergence, is a widely used technical indicator that helps traders understand trend direction and momentum. From beginners learning chart basics to experienced traders refining entries, MACD remains popular because it combines clarity with depth in a single visual tool.

This guide explains MACD in plain English, showing how it works, how traders interpret its signals, and how to use it responsibly. By the end, you will understand what MACD tells you—and just as importantly, what it does not.

What Is MACD?

MACD is a momentum and trend-following indicator developed by Gerald Appel in the late 1970s. It measures the relationship between two moving averages of price to show whether momentum is strengthening or weakening.

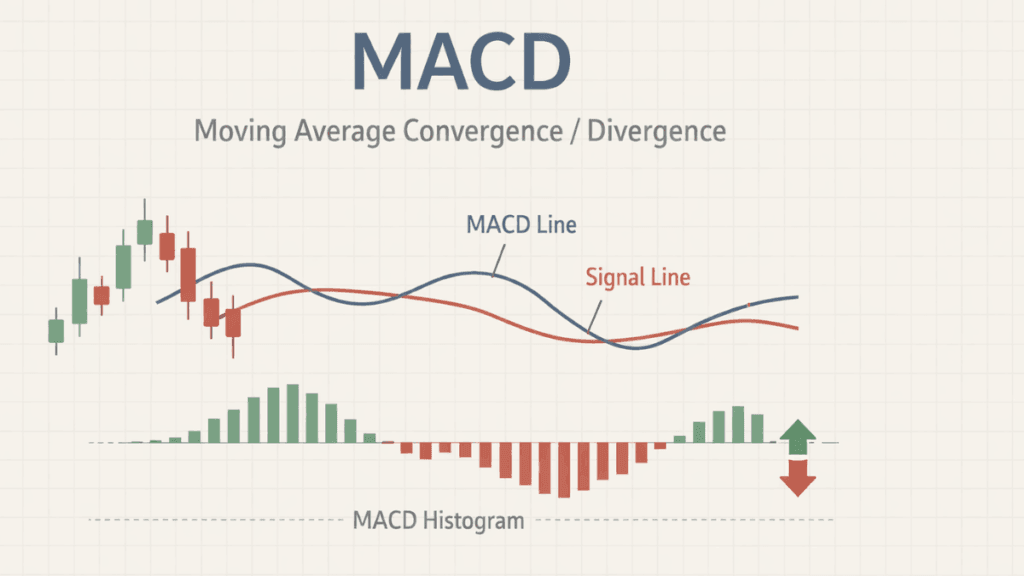

Unlike single-line indicators, MACD is displayed as a combination of lines and bars. This structure allows traders to analyze trend direction, momentum shifts, and potential turning points from one indicator.

How MACD Is Calculated

MACD is built from exponential moving averages (EMAs), which give more weight to recent prices. While the formula may look technical, understanding the components is enough for practical use.

The MACD Line

The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA. This line reacts to changes in price momentum and forms the foundation of the indicator.

When the MACD line rises, it suggests bullish momentum is increasing. When it falls, bearish momentum may be gaining strength.

The Signal Line

The signal line is a 9-period EMA of the MACD line. Its purpose is to smooth the MACD line and make potential signals easier to spot.

Traders often focus on how the MACD line behaves relative to the signal line. Crossovers between the two are among the most common MACD signals.

The Histogram

The histogram shows the distance between the MACD line and the signal line. It appears as bars above or below a central zero line.

Growing bars suggest strengthening momentum, while shrinking bars may indicate momentum is fading. Many traders find the histogram useful for spotting early changes before crossovers occur.

Understanding the Zero Line

The zero line is a key reference point in MACD analysis. It separates bullish conditions from bearish ones.

When MACD is above zero, the shorter-term moving average is above the longer-term average, signaling an overall upward bias. When MACD is below zero, the longer-term trend tends to be downward.

Common MACD Trading Signals

MACD provides several well-known signals that traders use to guide decisions. Each signal works best when combined with context rather than used in isolation.

MACD Line and Signal Line Crossovers

A crossover happens when the MACD line crosses the signal line. These crossovers often suggest a potential change in momentum.

- A bullish crossover occurs when the MACD line crosses above the signal line.

- A bearish crossover occurs when the MACD line crosses below the signal line.

Crossovers are most reliable when they align with the broader market trend.

Zero Line Crossovers

Zero line crossovers occur when the MACD line moves above or below the zero line. These signals often reflect a shift in overall trend direction rather than short-term momentum.

Traders usually treat zero line crossovers as confirmation signals rather than early entry points.

MACD Divergence

Divergence happens when price and MACD move in opposite directions. This situation can hint that the current trend is losing strength.

Bullish divergence forms when price makes lower lows while MACD makes higher lows. Bearish divergence appears when the price makes higher highs while the MACD makes lower highs.

How Traders Use MACD in Real Markets

MACD can be applied across many asset classes, including stocks, forex, cryptocurrencies, and commodities. Its flexibility makes it suitable for different trading styles and timeframes.

Swing traders often use MACD on daily charts to capture medium-term moves. Day traders may apply it on shorter timeframes while relying more heavily on confirmation from price action.

MACD vs RSI and Other Indicators

MACD differs from oscillators like RSI because it focuses on momentum within trends rather than overbought or oversold conditions. This distinction makes MACD more effective in trending markets.

Many traders combine MACD with RSI, support and resistance, or moving averages. This approach reduces false signals and improves overall decision-making.

Strengths of the MACD Indicator

MACD has remained popular for decades because it offers several practical advantages.

- It combines trend and momentum in one indicator.

- It works across multiple timeframes and markets.

- It is easy to interpret visually, even for beginners.

These strengths make MACD a reliable foundation for many trading strategies.

Limitations and Common Mistakes

While MACD is powerful, it is not flawless. Like all indicators, it is based on past price data and can lag during fast market moves.

Traders often make the mistake of taking every crossover as a signal. Without considering trend direction, support levels, or market conditions, MACD signals can become misleading.

Best Practices for Using MACD Effectively

Successful use of MACD comes from disciplined application rather than constant signal chasing. Traders should focus on quality setups instead of frequency.

Using MACD alongside price structure, volume, and higher-timeframe analysis improves accuracy. Backtesting strategies and managing risk remain essential regardless of indicator choice.

Is MACD Suitable for Beginners?

MACD is beginner-friendly because it is visually intuitive and widely available on trading platforms. Its structure helps new traders learn how momentum and trends interact.

At the same time, MACD offers enough depth to remain useful as experience grows. This balance explains why it continues to be taught in trading education and professional analysis.

Final Thoughts

MACD stands out as a practical and time-tested indicator for understanding market momentum and trend direction. When used thoughtfully and in context, it can help traders make more informed decisions.

Rather than treating MACD as a standalone solution, view it as a guide that supports clear analysis and disciplined risk management. This mindset is what turns a popular indicator into a consistently useful tool.