Paybill number is one of the most widely used mobile payment methods in Kenya, enabling individuals and businesses to receive money directly through M-Pesa. It plays a central role in everyday transactions such as paying utility bills, school fees, rent, loan repayments, and online services. Because Paybill transactions are structured and traceable, they are trusted by banks, companies, and service providers across the country.

This guide explains what Paybill number is, how it works, how to use it correctly, and when it is the best payment option compared to alternatives like Till Numbers.

What Is Paybill?

Paybill is an M-Pesa payment service that allows customers to send money to an organization or business using a unique Paybill number and an account reference. The account number identifies the specific customer, invoice, or service being paid for, ensuring accurate allocation of funds.

Unlike casual money transfers between individuals, Paybill is designed for structured payments where records, reconciliation, and accountability are essential. This is why it is commonly used by banks, schools, utilities, government agencies, and large businesses.

How Paybill Works

A paybill number works by linking a business or institution to a dedicated Paybill number provided by Safaricom. When a customer sends money, the funds are routed to the organization’s account based on the account number entered during payment.

The process is reliable because each transaction carries two identifiers: the Paybill number and the account reference. This structure minimizes errors and makes it easier for organizations to track payments without manual follow-ups.

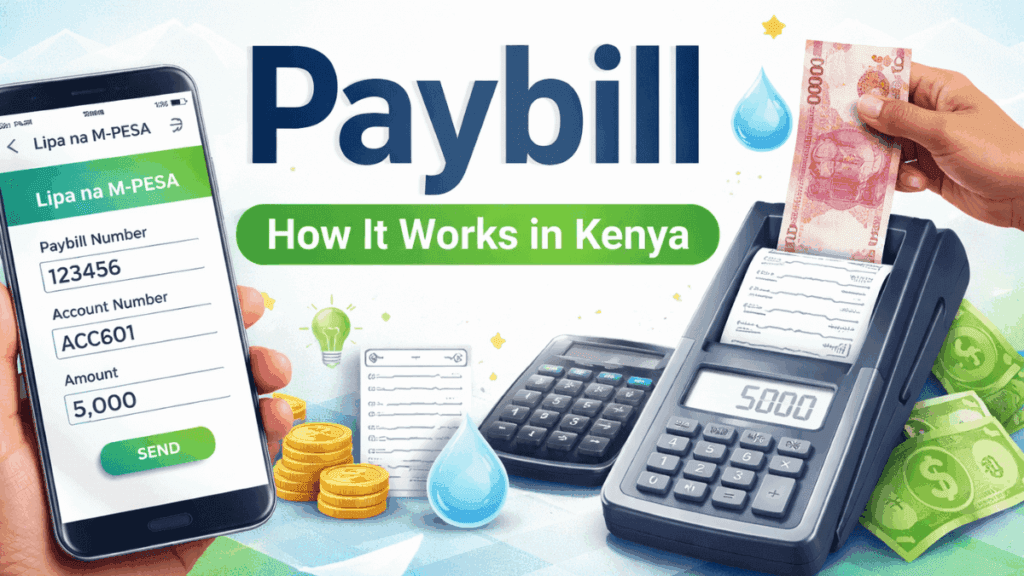

How to Pay Using a Paybill Number

Paying via Paybill is simple, but accuracy is important to ensure the payment reaches the correct account. The steps are designed to be straightforward for both first-time and regular users.

To make a Paybill payment:

- Open the M-Pesa menu on your phone.

- Select Lipa na M-Pesa.

- Choose Paybill.

- Enter the Paybill number provided by the business.

- Enter the correct account number or reference.

- Enter the amount and confirm with your M-Pesa PIN.

Once completed, both the sender and the recipient receive an SMS confirmation, which serves as proof of payment.

Common Uses of Paybill in Kenya

Paybill is used across many sectors because it supports organized and high-volume payments. Its flexibility makes it suitable for both recurring and one-time transactions.

Typical uses include:

- Paying electricity, water, and internet bills

- Settling bank loans and mobile lending repayments

- Paying school fees and university charges

- Making insurance premium payments

- Paying for online services and subscriptions

These use cases highlight why Paybill is preferred where payment tracking is critical.

Paybill vs Till Number

Although both Paybill and Till Numbers are used for receiving M-Pesa payments, they serve different purposes. Understanding the difference helps users and businesses choose the right option.

A Paybill requires an account number, making it ideal for payments that must be linked to a specific customer or invoice. A Till Number does not require an account number and is commonly used for instant retail payments, such as shops and restaurants.

In simple terms, Paybill is best for structured payments, while Till Numbers are best for quick, face-to-face transactions.

Paybill Charges Explained

Paybill transactions attract standard M-Pesa charges, which are usually paid by the sender unless the business has arranged otherwise. The charges depend on the amount being sent and follow Safaricom’s official M-Pesa tariff.

For businesses, receiving money via Paybill may also involve settlement or withdrawal charges, especially when funds are moved to a bank account. These costs are often outweighed by the benefits of secure and traceable payments.

Benefits of Using a Paybill Number

Paybill offers practical advantages that go beyond convenience. These benefits explain why it remains a core payment method in Kenya’s digital economy.

Key benefits include:

- Accurate payment tracking through account references

- Reduced cash handling and fraud risk

- Easy reconciliation for accounting and reporting

- Nationwide accessibility via M-Pesa

- High trust among customers and institutions

These advantages make Paybill suitable for both large organizations and growing businesses.

How Businesses Get a Paybill Number

Businesses can apply for a Paybill number directly from Safaricom or through approved partners. The process involves submitting business registration documents, bank account details, and proof of compliance with Safaricom’s requirements.

Once approved, the Paybill number is linked to the business’s settlement account. This setup allows automatic or manual transfer of funds to a bank, depending on the arrangement.

Security and Reliability of Paybill

Paybill transactions are protected by M-Pesa’s security systems, including PIN authentication and transaction confirmations. Every payment generates a unique transaction code, which can be used to verify or resolve disputes.

Because Paybill payments are recorded digitally, they provide a reliable audit trail. This level of transparency is one reason Paybill is trusted for sensitive payments such as loans, school fees, and government services.

When Paybill Is the Best Choice

Paybill is the best option when payments need to be clearly identified and matched to a specific account or service. It is especially useful where manual reconciliation would be time-consuming or error-prone.

For businesses that issue invoices, manage subscriptions, or handle large customer volumes, Paybill offers structure and control that simpler payment methods cannot provide.

Popular Paybills Numbers

Below is a list of popular paybills for Banks, Utilities, Betting, and Services. Find businesses, Paybills numbers, and instructions on how to pay

Banks

ABC BANK PAYBILL – 111777

ABSA BANK PAYBILL – 303030

BANK OF AFRICA (BOA) PAYBILL – 972900

CFC STANBIC PAYBILL – 600100

CHASE BANK PAYBILL – 552800

CO-OPERATIVE BANK PAYBILL – 400200

COMMERCIAL BANK OF AFRICA PAYBILL – 880100

CONSOLIDATED BANK LTD PAYBILL – 508400

CREDIT BANK PAYBILL – 972700

DIAMOND TRUST BANK (DTB) PAYBILL – 516600

ECOBANK PAYBILL – 700201

EQUATORIAL COMMERCIAL BANK PAYBILL – 498100

EQUITY BANK PAYBILL – 247247

FAMILY BANK LTD PAYBILL – 222111

GUARDIAN BANK PAYBILL – 344500

GULF AFRICAN BANK PAYBILL – 985050

HOUSING FINANCE COMPANY LTD PAYBILL – 100400

I & M BANK LIMITED PAYBILL – 542542

IMPERIAL BANK LTD PAYBILL – 800100

JAMII BORA BANK PAYBILL – 529901

K-REP BANK PAYBILL – 111999

KENYA COMMERCIAL BANK PAYBILL – 522522

KENYA WOMEN MICROFINANCE BANK PAYBILL – 101200

MUSONI MICROFINANCE PAYBILL – 514000

NCBA BANK PAYBILL – 880100

NATIONAL BANK PAYBILL – 547700

NIC BANK LIMITED PAYBILL – 488488

POST OFFICE SAVINGS BANK PAYBILL – 200999

PRIME BANK PAYBILL – 982800

RAFIKI DTM PAYBILL – 802200

SMEP DTM PAYBILL – 777001

STANDARD CHARTERED BANK PAYBILL – 329329

STANBIC BANK PAYBILL – 600100

TRANSNATIONAL BANK PAYBILL – 862862

UBA BANK PAYBILL – 559900

VISION FUND KENYA PAYBILL – 200555

Utilities and Telecoms

FAIBA PAYBILL – 330330

GOTV PAYBILL – 423655

KPLC NEW CONNECTION PAYBILL – 888899

KPLC POST PAY PAYBILL – 888888

KPLC PREPAID PAYBILL – 888880

NAIROBI WATER AND SEWERAGE COMPANY PAYBILL – 444400

SAFARICOM (POST PAID AND PRE PAID) PAYBILL – 200200

TELKOM PAYBILL – 777711

ZUKU PAYBILL – 320320

STARTIMES PAYBILL – 585858

Betting and Gaming

1XBET PAYBILL – 290027

1XBET PAYBILL – 290011

SPORTPESA PAYBILL – 5212121

Services and Merchants

COPIA PAYBILL – 4068913

DSTV PAYBILL – 444900

ECITIZEN SERVICES PAYBILL – 206206

HOPE SPEED PAYBILL – 4019575

JANADA PAYBILL – 156076

JONNEL COMMUNICATION PAYBILL – 180705

JOVAN COMMUNICATION PAYBILL – 833030

MILTON SONS PAYBILL – 665511

MYAIRTIME PAYBILL – 256356

NAIVAS PAYBILL – 552883

NHIF PAYBILL – 200222

NSSF PAYBILL – 333300

OKAZIKA PAYBILL – 156215

ONFON PAYBILL – 4104151

PESAPAL PAYBILL – 220220

TALLA PAYBILL – 851900

TENWEK HOSPITAL PAYBILL – 605664

TUPAY PAYBILL – 737373

Final Thoughts

Paybill numbers remain a cornerstone of Kenya’s mobile payment ecosystem because they combine convenience, structure, and trust. For users, it offers a simple way to pay bills accurately. For businesses and institutions, it provides reliable payment tracking and financial accountability.

Understanding how Paybill works and when to use it helps both individuals and organizations make smarter, safer payment decisions in an increasingly cashless economy.