The Relative Strength Index (RSI) is one of the most widely used momentum indicators in technical analysis, valued for its simplicity and reliability. Traders use the Relative Strength Index to measure the speed and strength of price movements, helping them judge whether an asset may be overbought or oversold.

Unlike price-based indicators that follow trends directly, RSI focuses on momentum and internal market strength. This makes it especially useful for identifying potential reversals, confirming trends, and improving trade timing across stocks, forex, cryptocurrencies, and commodities.

What Is the Relative Strength Index?

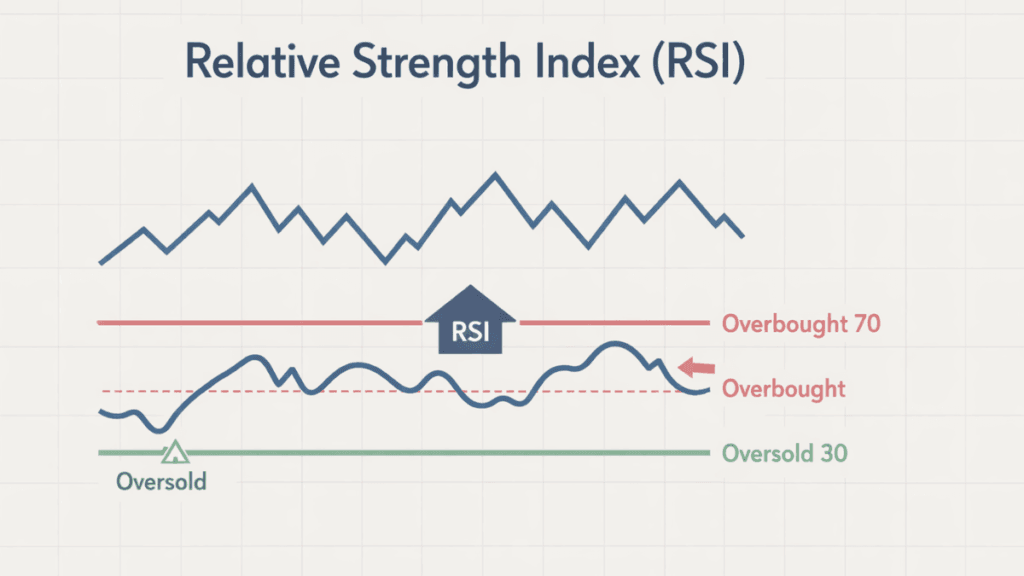

The Relative Strength Index is a momentum oscillator that moves between 0 and 100. Its purpose is to show whether buying or selling pressure is dominating the market at a given time.

RSI was developed by J. Welles Wilder Jr. and introduced in his 1978 book New Concepts in Technical Trading Systems. Since then, it has become a standard tool on nearly every trading platform due to its adaptability and ease of interpretation.

How the Relative Strength Index Works

RSI compares the average size of recent gains to the average size of recent losses over a defined period. This comparison produces a single line that fluctuates within a fixed range, making it easy to spot extremes.

Most traders use a 14-period RSI by default. Shorter periods make RSI more sensitive, while longer periods smooth the indicator and reduce noise.

The RSI Formula Explained Simply

The RSI calculation is based on relative strength rather than absolute price levels. It measures momentum by comparing upward price movement to downward price movement.

In practical terms, RSI increases when gains are stronger than losses and decreases when losses outweighs gains. Traders do not need to calculate it manually, but understanding the logic helps avoid misinterpreting signals.

Understanding RSI Levels and Thresholds

RSI levels provide a framework for interpreting market conditions. These levels are guidelines rather than fixed rules and should always be read in context.

Overbought and Oversold Zones

RSI values above 70 usually suggest that an asset is overbought. This means the price has risen quickly and may be due for a pause or pullback.

RSI values below 30 typically indicate oversold conditions. This suggests selling pressure may be exhausted and a rebound could occur, especially in range-bound markets.

The Importance of the 50 Level

The 50 level acts as a midpoint that reflects the overall momentum direction. When RSI stays above 50, bullish momentum tends to dominate.

When RSI remains below 50, bearish momentum is usually stronger. Many traders use this level to confirm trend direction rather than to time entries.

Common RSI Trading Signals

RSI produces several well-known signals that traders use to anticipate market behavior. These signals become more reliable when combined with price structure and trend analysis.

RSI Crosses Above or Below Key Levels

A move above 30 can signal that bearish momentum is fading. A move below 70 can suggest bullish momentum is slowing.

These crossings are most effective when they align with support, resistance, or broader market structure.

RSI Divergence

RSI divergence occurs when the price and the indicator move in opposite directions. This often hints at weakening momentum rather than an immediate reversal.

Bullish divergence forms when price makes a lower low while RSI makes a higher low. Bearish divergence appears when the price makes a higher high, but RSI forms a lower high.

Using RSI in Trending Markets

RSI behaves differently in trending markets compared to sideways ones. Understanding this difference helps traders avoid premature exits.

In strong uptrends, RSI often stays between 40 and 80 instead of reaching oversold levels. In downtrends, RSI may remain between 20 and 60 for extended periods.

Using RSI in Range-Bound Markets

RSI is especially effective in sideways or range-bound conditions. In these environments, overbought and oversold signals tend to work more consistently.

Traders often look to sell near RSI 70 and buy near RSI 30 when the price is moving within a clear horizontal range.

RSI vs Other Momentum Indicators

RSI is often compared to other momentum tools, but it has distinct strengths that set it apart.

Unlike the Stochastic Oscillator, RSI focuses on average gains and losses rather than price position within a range. Compared to MACD, RSI reacts faster to short-term momentum changes.

Best RSI Settings for Different Trading Styles

RSI settings can be adjusted to match different trading approaches. There is no single “best” setting, but context matters.

- Short-term traders often use RSI periods between 5 and 9 for faster signals.

- Swing traders commonly stick with the standard 14-period RSI

- Long-term traders may use periods of 21 or higher to filter noise

Common Mistakes When Using the Relative Strength Index

Many traders misuse RSI by treating it as a standalone decision tool. This often leads to false signals and frustration.

RSI can remain overbought or oversold for long periods during strong trends. Acting too early without confirmation is one of the most common errors.

How to Combine RSI with Other Indicators

RSI works best when paired with complementary tools. Combining it with trendlines, moving averages, or support and resistance improves accuracy.

For example, RSI divergence near a major support level carries more weight than divergence in the middle of a price range.

Strengths and Limitations of RSI

RSI is popular because it is simple, flexible, and easy to interpret. It adapts well to different markets and timeframes.

However, RSI is not predictive on its own. It measures momentum, not future price direction, which means confirmation is always essential.

Who Should Use the Relative Strength Index?

RSI is suitable for beginners because it is visually intuitive and widely documented. At the same time, experienced traders value it for fine-tuning entries and exits.

Whether you trade stocks, forex, or crypto, RSI provides a consistent framework for understanding momentum and market pressure.

Final Thoughts

The Relative Strength Index remains a core technical indicator because it balances simplicity with depth. When used thoughtfully, it helps traders read momentum, manage risk, and improve decision-making.

Rather than relying on RSI signals in isolation, the most effective approach is to combine them with price action and market context. Used this way, RSI becomes a powerful companion rather than a shortcut.