The Relative Vigor Index (RVI) is a momentum-based technical indicator designed to show whether a price trend has real strength behind it. It works on a simple idea: in healthy trends, prices tend to close higher than they open in uptrends and lower than they open in downtrends.

Unlike indicators that focus only on price direction, the Relative Vigor Index looks at how prices behave within each trading period. This makes it especially useful for traders who want confirmation that a trend is supported by consistent buying or selling pressure, rather than short-term noise.

What Is the Relative Vigor Index?

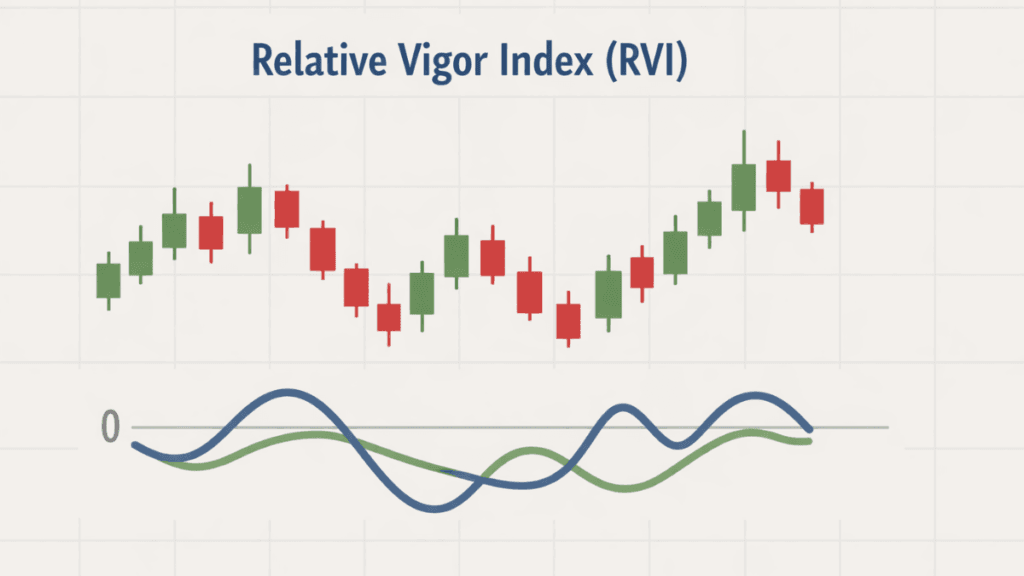

The Relative Vigor Index is an oscillator that compares a security’s closing price to its opening price over a chosen period. It then smooths this comparison to highlight the underlying trend strength more clearly.

The indicator typically appears below the price chart and moves around a central zero line. By itself, it does not predict price, but it helps traders judge whether the current trend has enough momentum to continue.

The Core Idea Behind the RVI

The logic behind the Relative Vigor Index is rooted in market behavior rather than complex math. In rising markets, buyers usually stay active into the close, while in falling markets, sellers often dominate toward the end of the session.

By tracking this open-to-close relationship over time, the RVI attempts to measure the “conviction” of market participants. Strong conviction often leads to more reliable trends, while weak conviction can signal indecision or a potential slowdown.

How the Relative Vigor Index Is Calculated

The calculation of the Relative Vigor Index compares the difference between the close and the open to the overall price range. This raw value is then smoothed using moving averages to reduce randomness.

Most trading platforms handle this calculation automatically. For practical trading purposes, understanding the concept matters more than memorizing the formula, especially for beginners.

Understanding the RVI Indicator Line and Signal Line

The Relative Vigor Index usually consists of two lines: the RVI line and a signal line. The RVI line reflects the smoothed open-to-close relationship, while the signal line is a further smoothed version used for confirmations.

Crossovers between these two lines are among the most common trading signals. These crossovers help traders spot potential changes in momentum rather than reacting to price alone.

How to Read Relative Vigor Index Signals

The Relative Vigor Index produces signals that are best used as confirmations rather than standalone triggers. When interpreted correctly, these signals can improve timing and reduce false entries.

The most common RVI signals include:

- Crossovers between the RVI line and the signal line

- Movement above or below the zero line

- Divergences between RVI and price

Each of these signals provides insight into momentum strength rather than guaranteed outcomes.

RVI Line and Signal Line Crossovers

Crossovers are the most straightforward way to use the Relative Vigor Index. When the RVI line crosses above the signal line, it suggests rising bullish momentum, while a cross below suggests growing bearish momentum.

These signals tend to work best when aligned with the broader market trend. In sideways markets, crossovers may occur frequently and should be treated with caution.

Zero Line Interpretation in the RVI

The zero line acts as a neutral reference point for the Relative Vigor Index. When the indicator is above zero, bullish pressure is stronger; when it is below zero, bearish pressure dominates.

Zero-line crossovers can help confirm trend shifts, especially on higher time frames. However, they often lag price movements, which is why many traders combine them with other tools.

Bullish and Bearish Divergences

Divergence occurs when price and the Relative Vigor Index move in opposite directions. A bullish divergence forms when price makes lower lows while the RVI makes higher lows, suggesting weakening selling pressure.

Bearish divergence appears when the price makes higher highs, but the RVI fails to confirm them. These signals can hint at trend exhaustion, though they work best when confirmed by price action or support and resistance.

Best Timeframes for Using the Relative Vigor Index

The Relative Vigor Index can be applied to any timeframe, from intraday charts to long-term investments. Its effectiveness often improves on higher timeframes, where price noise is reduced.

Short-term traders may still use the RVI, but they should expect more frequent signals and a higher chance of false readings. Adjusting settings and combining indicators becomes more important in these cases.

How Traders Use the RVI in Real Strategies

Traders rarely rely on the Relative Vigor Index alone. Instead, they use it as a confirmation tool alongside trend analysis, chart patterns, or moving averages.

For example, a trader might wait for a pullback in an uptrend and then look for a bullish RVI crossover to confirm renewed momentum. This approach helps align entries with the prevailing trend rather than chasing price.

Combining the Relative Vigor Index With Other Indicators

The Relative Vigor Index pairs well with indicators that focus on direction rather than momentum. Moving averages, trendlines, and support and resistance levels are common companions.

It can also complement other oscillators, such as RSI or MACD, when used carefully. The key is to avoid redundancy and focus on confirmation rather than signal overload.

Common Mistakes When Using the RVI

One common mistake is treating the Relative Vigor Index as a predictive tool instead of a confirmation indicator. It reflects momentum conditions that already exist rather than forecasting future prices with certainty.

Another issue is using the RVI in choppy, range-bound markets without filters. In these conditions, signals can appear reliable but fail quickly due to a lack of follow-through.

Strengths and Limitations of the Relative Vigor Index

The Relative Vigor Index offers a unique perspective by focusing on how prices close relative to their opens. This makes it valuable for confirming whether a trend is supported by consistent market behavior.

Its main limitation is lag, especially during sudden market reversals. Like most momentum indicators, it works best when combined with price structure and sound risk management.

Who Should Use the Relative Vigor Index?

The Relative Vigor Index is suitable for traders who already understand basic chart reading and want deeper insight into momentum quality. It is particularly helpful for trend-followers who prefer confirmation over early signals.

Beginners can also benefit from the RVI, provided they take time to learn its behavior and avoid overtrading. Its clear structure and logical foundation make it easier to understand than many complex indicators.

FAQs About Relative Vigor Index

1. What does the Relative Vigor Index measure?

It measures the strength of a trend by comparing the closing price to the trading range. A close near the high shows bullish strength, while a close near the low shows bearish weakness.

2. What is a good setting for the RVI?

The standard setting is 10 periods with a 4-period smoothed signal line. Most traders keep these defaults.

3. Is RVI the same as RSI?

No. RSI tracks price speed and change, while RVI focuses on where prices close within the trading range.

4. Can the RVI predict reversals?

Yes, especially through divergences between price and the RVI line. However, it should be confirmed with other tools.

5. Is the RVI useful for crypto trading?

Yes. Cryptocurrency markets are momentum-driven, and the RVI helps identify when closing strength aligns with trend direction.

Final Thoughts

The Relative Vigor Index is a thoughtful momentum indicator that focuses on the strength behind price movements rather than direction alone. Examining how prices open and close provides insight into whether buyers or sellers truly control the market.

Used correctly, the Relative Vigor Index can improve trade confidence and reduce impulsive decisions. When combined with solid chart analysis and disciplined risk management, it becomes a reliable tool for understanding trend strength rather than chasing signals.